Page 81 - Decoding Decisions ~ Making sense of the messy middle

P. 81

81 CHAPTER 4 INFLUENCING THE MESSY MIDDLE

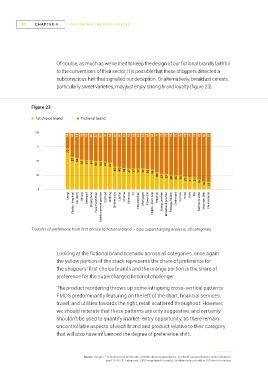

Of course, as much as we’ve tried to keep the design of our fictional brands faithful

to the conventions of their sector, it is possible that these shoppers detected a

subconscious hint that signalled our deception. Or alternatively, breakfast cereals,

particularly sweet varieties, may just enjoy strong brand loyalty (figure 23).

Figure 23

1st choice brand Fictional brand

100

28 43 44 48 49 50 50 50 51 53 60 60 62 63 63 63 63 64 65 71 73 73 75 75 76 78 79 79 82 86 87

75

72

50 57 56

52 51 51 50 50 49 47

40 40 38 37 37 37 37 36

25 35 30 27 27 25 25 25

22

21

18 21

14 13

0

Cereal Car (SUV) Whisky Detergent Cat food Clothing Laptop Cinema Shampoo TV Mortgages Power drill Make-up Credit card Car hire Hotel Sofa ISA

Flights - long haul Smartphone Face moisturiser Mobile network provider Children’s toy Fitted kitchen Flights - short haul Energy provider Broadband provider Package holiday Bathroom suite Mountain bike Car insurance

Transfer of preference from first choice to fictional brand – bias supercharging analysis, all categories.

Looking at the fictional brand scenario across all categories, once again

the yellow portion of the stack represents the share of preference for

the shoppers’ first choice brands and the orange portion is the share of

preference for the supercharged fictional challenger.

The product reordering throws up some intriguing cross-vertical patterns:

FMCG predominantly featuring on the left of the chart, financial services,

travel, and utilities towards the right, retail scattered throughout. However,

we should reiterate that these patterns are only suggestive, and certainly

shouldn’t be used to quantify market-entry opportunity, as there remain

uncontrollable aspects of each brand and product relative to their category

that will also have influenced the degree of preference shift.

Source: Google / The Behavioural Architects. 310,000 simulated purchases. n=31,000 category buyers, online shoppers,

aged 18-65 (31 categories, 1,000 respondents in each). Numbers may not add to 100 due to rounding.